In today's fast-paced world, financial emergencies can come up at any second, leaving people trying to find fast options to address pressing bills. This is where the concept of identical day loans comes into play, offering an immediate answer for those in want. Whether it's a sudden medical bill, car restore, or unexpected expense, identical day loans supply a rapid source of cash to satisfy pressing monetary demands. But what are the particular benefits and potential drawbacks of those loans? How do they work, and what should potential debtors know before applying? This article delves deep into the panorama of same day loans, exploring their advantages, application processes, alternative choices, and essential suggestions for responsible borrowing. By gaining a radical understanding of this financial software, individuals could make informed selections that align with their financial targets and circumstances.

Understanding Same Day Loans: What You Need to Know

Same day loans are short-term loans designed to provide debtors with cash on the identical day they apply. The key options of those loans embody quick approval processes, minimal paperwork necessities, and quick disbursement of funds, typically inside hours. Whereas traditional loans might take days and even weeks to process, same day loans cater to pressing monetary wants, making them a well-liked choice for many. However, it is important for debtors to acknowledge that the speed of those loans usually comes at a cost, with greater rates of interest and costs in comparison with standard loans. Understanding these characteristics may help borrowers navigate the options out there and are available to phrases with the implications of their decisions.

The Pros of Same Day Loans: Why They Are Appealing

One of probably the most notable advantages of identical day loans is the speed at which funds are made out there to debtors. In emergencies, such as medical emergencies or car breakdowns, timing could be essential. Same day loans remove the lengthy wait associated with traditional loan processes, allowing debtors to deal with financial issues promptly. Furthermore, the application process is commonly simplified, requiring fewer paperwork and less verification than traditional loans. This quick entry to money can relieve stress and assist debtors manage their cash circulate successfully.Another profit is the potential for improved credit score access for those with less-than-perfect credit score histories. Traditional lending establishments may deny functions based mostly on credit scores, but many identical day loan providers think about other elements, allowing extra individuals to safe monetary assistance. Additionally, the pliability of reimbursement phrases could be arranged based mostly on the borrower's situation, making these loans adaptable to varied wants.

Potential Drawbacks: What to Watch Out For

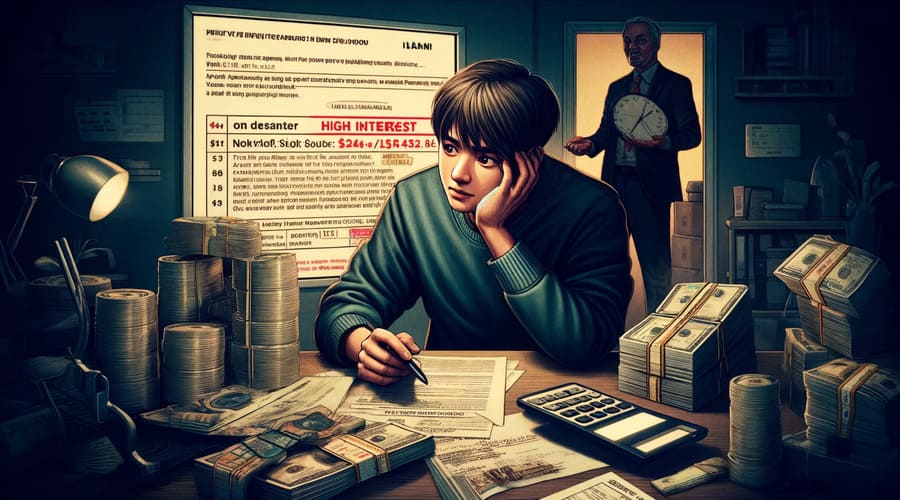

While identical day loans offer numerous benefits, they do not seem to be without their drawbacks. As beforehand mentioned, these loans have a tendency to come back with larger rates of interest and costs, which may lead to a cycle of debt if borrowers are not cautious. Failing to repay the loan on time can lead to additional fees and harm to credit scores, making it crucial for debtors to assess their compensation capabilities earlier than proceeding.Furthermore, the speed of obtaining these loans can create a sense of urgency that may lead individuals to miss important particulars within the mortgage settlement. It is crucial that borrowers take the time to read the fine print and absolutely perceive the terms, reimbursement schedules, and any hidden charges involved. Without this due diligence, people may find themselves in a more precarious monetary scenario than initially anticipated.

The Application Process: Steps to Secure a Same Day Loan

The utility process for acquiring a identical day loan is usually easy, consisting of some key steps. First, potential borrowers must determine a good lender who provides similar day loans that meet their needs. Once they select a lender, they will full the web application, which usually requires personal data, monetary particulars, and the quantity they want 회생파산 대출 to borrow.Next, the lender will review the application and take steps to verify the information supplied. This could include checking the individual's credit score historical past, revenue, and employment status. Given the character of similar day loans, many lenders can provide conditional approval inside a short while body. Once accredited, funds are often disbursed instantly into the borrower's checking account, making the entire course of efficient.

Alternatives to Same Day Loans: Exploring Other Options

While identical day loans serve a selected purpose, there are a quantity of options that debtors might contemplate if they do not seem to be comfy with the terms or costs related to these loans. One such choice is a private loan from a conventional bank or credit union, which may provide lower rates of interest and extra favorable repayment phrases. Although these loans might take longer to process, they will represent a extra sustainable financial resolution in the long run.Another alternative is looking for help from family or friends. Borrowing from family members can eliminate curiosity expenses and fees, permitting for a extra manageable 기타 대출 repayment schedule. However, it is necessary to talk clearly and ensure that both parties perceive the terms of the arrangement to stop potential strains on relationships.

Tips for Responsible Borrowing: Making Informed Decisions

Responsible borrowing is essential, particularly when considering identical day loans. One important tip is to assess your monetary state of affairs realistically earlier than making use of for a loan. Determine whether or not you genuinely want the funds and if you are able to repaying the mortgage within the stipulated timeframe. Setting a budget that accounts for the mortgage compensation can help stop falling behind on funds.Additionally, borrowers ought to shop around for different lenders and examine their terms, interest rates, and fees before making a call. This analysis can uncover better choices that swimsuit their monetary wants. Using on-line comparability instruments can simplify this course of and assist debtors find lenders that supply competitive charges and phrases.

Real-Life Examples: Success Stories and Lessons Learned

Many individuals have successfully navigated monetary emergencies utilizing identical day loans. For example, a college student faced an sudden medical invoice however didn’t have financial savings to cowl the expense. After researching, they utilized for a similar day mortgage, secured the funds rapidly, and were capable of pay the invoice, ultimately managing to repay the loan within a month with out going through any negative impacts on their credit rating.Conversely, one other individual found themselves in a troublesome state of affairs after taking out a identical day mortgage with out fully understanding the loan’s conditions. The high curiosity compounded quickly upon missing the reimbursement deadline, making a snowball impact that made it difficult to regain monetary stability. This instance highlights the significance of economic literacy and understanding lending phrases, emphasizing that data is vital to responsible borrowing.

Conclusion: Making the Right Choice for Your Financial Future

As the panorama of non-public finance continues to evolve, understanding the role of same day loans can empower people to make knowledgeable choices regarding their monetary well-being. While these loans present fast entry to essential funds, the potential pitfalls necessitate careful consideration and accountable borrowing practices. By weighing the benefits and downsides, exploring options, and being knowledgeable at every stage of the process, borrowers can navigate monetary emergencies with confidence and readability. Ultimately, the objective is to secure one's financial future and keep away from creating new challenges that Have a peek here may stem from impulsive borrowing selections.

Comments on “Financing Techniques for Independent Workers: Managing Income Fluctuations”